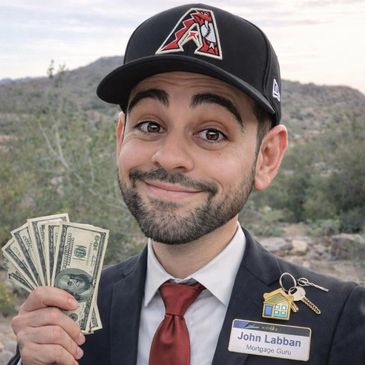

John Labban Mortgage Guru NMLS #920783

With nearly 14 years of experience in the industry, let me use my experience to help you close on your next mortgage loan.

With nearly 14 years of experience in the industry, let me use my experience to help you close on your next mortgage loan.

What I originate:

Products offered:

Programs Offered:

Why would you work with John:

Phone: (904) 250-8730 Email: jlabban@mutualmortgage.com

Federal Reserve chose to hold rates steady in their first meeting of the year in 2026. Will they issue an interest rate cut in March?

DaysDays

HrsHours

MinsMinutes

SecsSeconds

Copyright © 2026 John Labban Mortgage Guru (NMLS #920783) - All Rights Reserved. Please note this is an independent site and not an official company site. I am a mortgage loan officer and my personal site with ALL views expressed on this site are my own and not my company's.

Currently a mortgage loan officer with Mutual of Omaha Mortgage (NMLS 1025894) in Scottsdale, AZ. Mutual of Omaha Mortgage headquarters are located at 3131 Camino Del Rio N, Suite 100 - San Diego, CA 92108.

Home Equity Lines of Credit and Home Equity Installment Loans available. Certain conditions apply and must meet credit, loan to value, income, and asset requirements. Please call me for details.

All loans are subject to credit approval. Loans are also subject to income and asset verification. All state and data privacy laws are observed.

Equal Opportunity Housing Lender.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.

I am now licensed in 37 states. I can help with purchase, refinance, and home equity loans. Once we're on the phone, I will take you through the process.